In this Financial Samurai podcast episode, I talk to Ben Miller, co-founder and CEO of Fundraising On his outlook for residential and commercial real estate in 2025. Despite the rise in mortgage rates, he took a positive outlook and shared the main reasons behind it.

Listen to my conversation with Ben by pressing play below or skip to the episode on apple or Spotify.

Positive reasons for residential and commercial real estate in 2025

In my message, How would I invest $250,000 today?I touched on why I believe residential and commercial real estate represents a compelling investment opportunity in 2025. However, with mortgage rates stubbornly high at the start of the year, some doubts have crept in.

Naturally, I was excited to hear Ben’s optimistic perspective on this topic. Here’s a summary of the four main reasons why Ben is bullish on commercial residential real estate in 2025, as discussed on the podcast.

You will notice some Doubt In my voice I challenge certain points in his arguments. Since there are no guarantees when investing in risky assets, it is always wise to uncover any potential blind spots.

1) Valuation difference between stocks and real estate Very spacious

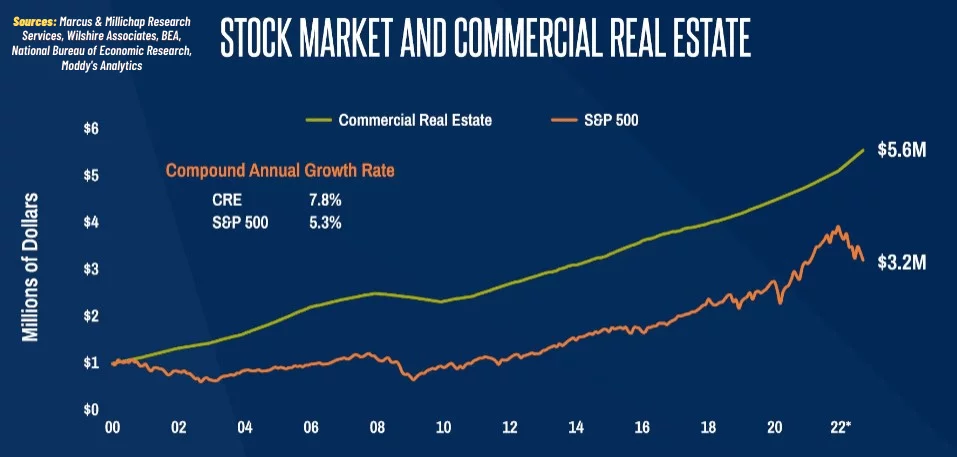

The S&P 500 trades at roughly 22 times forward earnings, which is well above the historical average forward P/E of 17 times. Historically, investing in stocks at such high valuations has often led to lackluster returns.

Meanwhile, commercial real estate prices have fallen more than 20% in the past two years, with stocks rising more than 50%. This huge valuation gap looks unsustainable, especially if mortgage interest rates start to fall.

Below is a graph that caught my attention because it highlights how apartment values have fallen to levels similar to those seen during the global financial crisis. However, the economy and household balance sheets are much stronger today. This disconnect makes me optimistic about residential and commercial real estate, where prices have rebounded sharply in the wake of the global financial crisis.

In 2010, I distinctly remember wanting to create a fund to buy all the residential properties in Vallejo, a city 29 miles north of San Francisco that had declared bankruptcy. However, I lacked the funds and connections to make it happen. Today, I can simply invest in a residential-commercial real estate fund and gain exposure to real estate at deep discounts.

2) Out-of-alignment performance correlation

Historically, stocks and commercial real estate have been highly correlated, with both reflecting the broader economy. From 2012 to 2022, their performance moved in tandem. A healthy economy benefits both asset classes.

However, since 2022, this correlation has broken down, creating an opportunity for those who believe in mean reversion. Furthermore, in the event of a potential recession, real estate could outperform stocks as investors shift toward more stable assets.

3) Shortage of housing supply in the future

Higher interest rates since 2022 have slowed new construction significantly, even in builder-friendly cities like Austin and Houston. New housing construction in Houston is down 97%, Kostar says. This multi-year pause in development sets the stage for a shortage in housing supply.

Ben, with his company’s massive portfolio of residential and commercial properties, believes the oversupply from the building boom through 2021 will be absorbed by the end of 2025, if not by mid-2025, faster than many estimates. As a result, rents and residential and commercial property prices are expected to start rising again by late 2025 and beyond. Their portfolio is already seeing a return to rental growth.

In the interview, I also made my argument that a return to office would boost commercial real estate in major cities like New York City, San Francisco, Boston, Seattle, and Los Angeles, where building new projects is significantly more difficult. However, Ben remains skeptical, citing technological progress as a counterpoint.

4) Reduced risk of inflation acceleration

There are widespread concerns that a second Trump term could lead to significant inflation. However, the economy in 2015, 2016 and 2017 was much stronger than it is today. However, despite strong growth and eventual tax cuts after Trump took office on January 20, 2017, inflation remained relatively low until the pandemic struck.

In addition, Trump pledged to fight inflation during his election campaign, indicating that he is unlikely to pursue policies that might worsen inflation.

Demographics also point to a long-term contractionary trend. As America’s birth rate declines, slowing population growth is likely to put downward pressure on inflation.

Investing in commercial real estate for the long term

As a value investor, I’m always looking for discontinuities in historical performance and valuations. Many personal finance enthusiasts likely share this mindset, as we tend to be more frugal and cost-conscious.

In 2025, I would rather allocate more new investment dollars to undervalued commercial residential properties rather than expensive stocks. After the S&P 500’s strong performance in 2023 and 2024, it’s hard to imagine the index delivering huge returns again in 2025.

So far I have invested about $300,000 Fundraisinga trusted partner and long-time sponsor of Financial Samurai. With a low minimum investment of just $10, dollar cost averaging in commercial real estate has never been more accessible.

To accelerate your journey to financial freedom, join over 60,000 others and sign up Samurai’s free financial newsletter. Financial Samurai is among the largest independently owned personal finance sites, founded in 2009. Everything is written based on experience and first-hand experience.