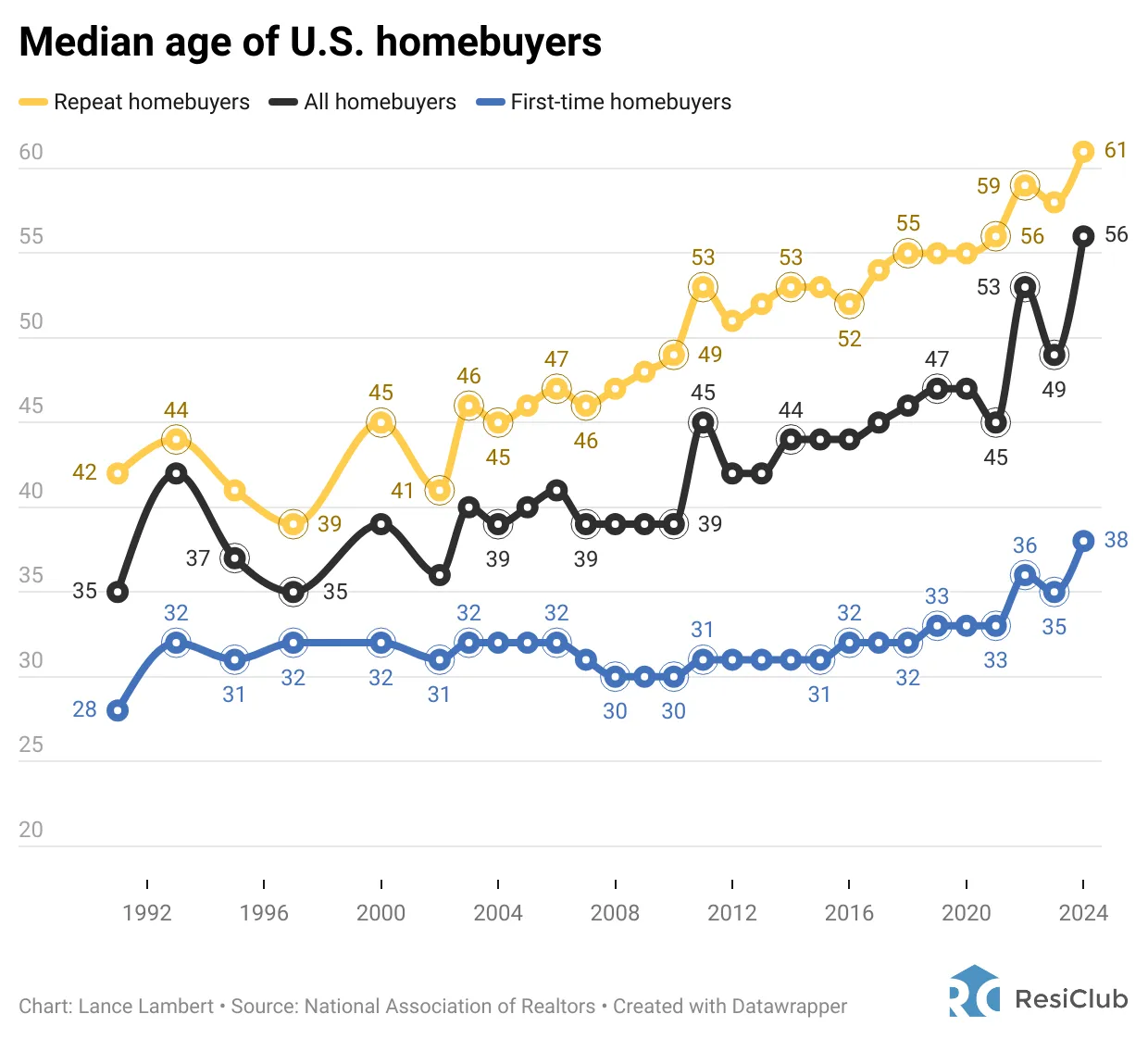

I have recently encountered an open plan by the National Association of Real Estate Bidgers who show that the average age of the US home buyers for the first time is 38 years old. This is a 30 -year -old leap between 2008 and 2010. Meanwhile, the average age for frequent buyers has risen to 61.

What happens here?

These numbers amaze me because of Life is much shorter than delaying the purchase of a house for a long time. After Covid, the average life expectancy in the United States becomes shorter, and no longer. Most people buy their first house with the intention of stability. However, if you only offer this commitment in 38 years, you may not enjoy housing ownership the way you imagined.

I understand that the high prices of homes and high mortgage rates are the main factors that contribute to this direction, which makes the ability to withstand costs more difficult. However, this post is no Those who are the ability to withstand costs target their main issue.

Instead, this post is directed to those who can buy a house, but they are waiting for the “ideal price” before taking action. The problem is that waiting indefinitely can delay the important features of life, which makes it difficult to retire early, start the family, and enjoy the full benefits of home ownership.

Your decrease in retirement 60

Waiting for the perfect price for buying a house, the retirement schedule can greatly restore. If you purchase your first home in 38 years, you are likely to get a 30-year-old mortgage-after all, about 95 % of the home buyers, although I prefer a modified mortgage (ARM) instead. The duration of your home ownership is matched with a decrease in the fixed rate is more logical.

By the time the mortgage is paid in 68 years, you may have already worked for five years or more of the traditional retirement era. If you have bought a 28 -year -old house instead, you will have a paid house by 58, allowing more flexible and enjoyable retirement.

Of course, some people may have saved and invest them strongly between 18-38 to achieve financial independence before buying a house. However, this is a smaller percentage of the population. Often a 38 -year -old home purchase means exhausting a large amount of money and investments, which may reflect any financial independence they have achieved.

I faced this immediately after purchasing our house in the fourth quarter of 2023 with cash from sales of stock and bonds. This decision caused a decrease in the negative investment income, leaving me at the worst point by 25 % of the desired home expenditures coverage. Now, I must spend the next 3-4 years compensation for this deficit, which delays my financial goals.

The start of the family may be more difficult

Many people aim to buy a house before having children, and to search for stability before expanding their families. However, delaying domestic ownership can make it difficult to start a family at an ideal age.

Fertility challenges increase after the age of 35, and women above this era are classified as “aging products” in the wings of motherhood. My wife and I faced this directly during the birth of our children in San Francisco. Several couples in our network struggled with pregnancy while waiting for a longer period of stability.

If you are planning to buy a house before a family starts but you don’t want to risk fertility complications, I recommend starting to organize your family once you get financial stability and the appropriate partner, instead of waiting for the “ideal” home to buy.

The clear value of at least twice on your total family income is a reasonable standard before having children. In general, the more your wealth before having children, the less stressful. Get the goal of the net value before the kindergarten runs.

Of course, it is completely good to start a family and rent. Just be sure to find a place owned by Malik who wants tenants in the long run.

Disadvantages are waiting for the ideal price

One of the biggest reasons that make people delay the ownership of homes is the belief that a better price will come. But the timing of the market is almost impossible. Even if you properly expect the market bottom, you may struggle to find the right house at the time. And if the ideal house appears, it is possible that an offer will be made to others, which leads to the price raised immediately.

Instead of trying the market time, buy a house when you can do it. If you meet at least my three base to buy the house in the framework of 30/30/3, you are in a good position. In addition, be sure to plan to own the house for at least five years due to the high costs of transactions.

Home ownership helps to protect against inflation by installing your housing costs. Endless rental exposes you to the increase in rent and instability. When you own, you can control your living situation and you can enjoy safely not to force you to move due to the owner’s decisions.

Upon rent, the rental is always 100 percent negative. Yes, you get a place to stay, but nothing more. Do not get a free living option or earn money from shelter.

Other examples where the price can be a better price

It is important to be costly aware, but waiting for the lowest possible price is not always the best financial decision. Below are other areas where waiting for negatively affects the quality of your life:

1. Emotional well -being and relationships

Sometimes, more spending for rest – such as taking a direct trip instead of withstanding long stops – can significantly improve your mental and physical health. Employing assistance, such as a nanny or house cleaner, can free time to focus on your career, family, or self -care. The cost is worth the stress.

2. Medical treatment

Health is invaluable. The delay of the necessary medical treatment can in the hope of low costs can lead to severe complications, higher expenses and worse results. Preventive care, regular checks, timely treatments provide money and long -term life.

3. Good time and experiences

Traveling with their loved ones, attending Milestone events, creating invaluable permanent memories. Skiping experiments such as taking your children to Disneyland or missing at a big concert to save money, unfortunately. You can always earn more money, but the lost time is indispensable. It is possible that you are not able to raise the course of 20 miles in the 1970s.

4. Professional and business opportunities

The conference, training course, or communication event may change the course of your career. Waiting for low prices to lose major communication or job progress opportunities.

5. The basic house or car repair

Simple leakage today can turn into great damage to the water tomorrow. The small car problem can escalate to an expensive collapse. Waiting for a “better deal” on the repairs often leads to greater financial losses on the road.

6. High -quality work tools

Suitable equipment can significantly increase productivity and profits. Slow laptop or old software can waste hours of valuable work time. I have this directly with MacBook Pro with 8 GB – constantly slowing, killing my efficiency. A new one will pay for improved productivity, but I cannot make myself buying a new one because she is only five years old.

7. Education and skills development

Investment in learning can lead to high age profits. A book on investment and personal financing can result in thousands of future gains. Waiting for $ 15 during the sale may lead to lost opportunities of 1,000.

8. Health and fitness spending

A good level, comfortable chair or membership of the gym can prevent health issues in the long run. Weak sleep or stable lifestyle leads to medical expenses that significantly exceed the initial cost of preventive measures. Will you really sleep your sleep for 11 months to wait for the sale of holidays?

9. Childhood features

Children get older. Skipping meaningful experiences to save money – such as extracurricular activities, vacations, or even pre -school levels – can mean losing the main development opportunities.

If something else deserves to spend money on it, along with a wonderful primary stay, it is on your children. Once they leave the house, 80 % – 90 % of the time you spend with them will disappear.

10. Appointing skilled professionals

Either for home renovations, childcare or financial advice, waiting for a lower price may mean losing access to higher talents. Skilled specialists in high demand, and the cheapest option is rarely the best.

You do not always have to improve savings – pushing for rest

Instead of always improving savings, use your increasing wealth to enhance your lifestyle and comfort. Pay 20 additional cents for gas for gas instead of leading another 10 minutes to provide a few dollars. Choose direct flights through stopping to save time and reduce stress. Relax a home cleaner to free family working hours, hobbies or relaxation. The practice of using your wealth to improve your life is less important than its construction.

Before buying my home in 2023, I analyzed the possibility that it would return to the market if I did not advance. It will be the fastest reselling possible in mid -2015, based on the seller’s plans. His daughter was graduating from high school in 2025 and stated that he wanted to return to his country of origin.

However, I couldn’t predict whether the price would remain on hand. If the stock market performance is good in 2024 and 2025, the demand may lead to high prices, making it difficult to buy. At the same time, if you buy the house, I will lose the gains of the stock market. In the end, the priority of certainty was given to potential savings.

Although I may have made more money by waiting, I can’t seek. I did not put my life or the comfort of my family for two years

What are your thoughts?

Have you been surprised by the average age of the housing buyer? How much is this due to the ability to bear costs in exchange for better prices? What are the other areas of life you have seen in delaying people for financial reasons, just to realize that it is not worth it? Let me know your thoughts!

Variety to high -quality private real estate

Arrows and bonds are classic food for retirement investment. However, I also suggest diversification to real estate – an investment that combines the stability of bond income with greater potential.

It is considered DonationA platform that allows you to invest in 100 % negatively in residential and industrial real estate. With approximately $ 3 billion of real estate assets under management, collecting donations focus on real estate in the Sunbelt region, where the assessments are lower, and the return tends to be higher.

With a strong economy, a strong stock market, pent -up demand, and attractive prices, I expect commercial real estate prices to continue to recover. I have personally invested more than $ 300,000 with donation, and they were a reliable and long sponsor for Financial Samurai. With an investment of $ 10, your wallet diversification was not easier.

Subscribe to the financial samurai

Listen and subscribe to the financial samurai podcast apple or Spotify. I meet experts in their fields and discuss some of the most interesting topics on this site. You have your shares, classifications and reviews.

To accelerate your journey to financial freedom, join more than 60,000 others and subscribe to Free samuraian financial newsletter. The Financial Samurai is among the largest independent -owned personal financing sites, which was established in 2009. Everything is written on the basis of direct experience and experience.