the Santa Claus Rally It refers to a historically observed phenomenon in the stock market where US stock markets tend to perform well during the last five trading days of the year and the first two trading days of the new year. Historically, the average profit over this seven-day period has existed 1.3%.

Over time, this is largely due to bullish optimism Santa Claus Rally It extended in both duration and upward trend. today, Santa Claus Rally The rally begins as early as November 25 and continues through the end of the year. During this modern version of Santa Claus RallyThe average S&P 500 return doubles at 2.6%.

Origins of the Santa Claus Rally

The term was popularized by Yale Hirsch, creator of the stock traders’ calendar, in the 1970s. Hirsch noticed this recurring pattern of market strength during the holiday season and called it the “Santa Claus rally.”

While micro assets are not tied to any single event, this phenomenon has been recognized for decades and extensively studied in financial markets.

Historical trends of the Santa Claus gathering

- timing: The rise usually extends to the last five trading days of the calendar year and the first two trading days of the new year.

- performance: Historically, the S&P 500 has shown an average gain of about 1.3% over this seven-day period, which is significantly higher than the average weekly performance over the year.

- repetition: In more than 70% of cases, the markets achieved positive returns during this period. It’s similar to the way the S&P 500 is closed in any given year 70% of the time during the year.

Theories behind Santa Claus’ walk

Many theories try to explain why Santa Claus Rally It is happening:

- Optimism and Eid joy: The holiday season often fosters a sense of optimism among investors, leading to increased buying activity. As humans, most of us are programmed to expect better times in the future in order to survive.

- Tax considerations: Some investors sell their losing positions before the end of the year to capture tax losses, followed by reinvesting in the market. However, this sale must take place before November, usually in October Santa Claus Rally To have a greater chance of it happening. Tax loss harvesting may be one reason why October is one of the weakest trading months of the year.

- Low trading volume: With many institutional investors and traders on vacation, retail investors may exert greater influence on the market, often skewing it to the upside.

- End of year bonuses: An influx of year-end bonuses can lead to increased investment activity.

- Portfolio rebalancing: Fund managers may adjust portfolios to improve year-end performance metrics, increasing market gains.

- New year predictions: Investors are preparing for a strong start to the new year, contributing to the rally.

Wall Street is almost always optimistic in the fourth quarter

When I was working on Wall Street at Goldman Sachs and… Credit SuisseHadith Santa Claus Rally It will start in mid-November. As the end of the year approaches, the atmosphere becomes festive, and expectations for year-end rewards grow. These rewards often range from 20% to 250% of our base salaries, creating a visible buzz throughout the office.

November to February is arguably the best time to be an investment banker or trader on Wall Street. The pace had slowed down, holiday parties were in full swing, and the huge bonus checks made it all the more rewarding. It was a time to celebrate the hard work we had put in over the year and enjoy the fruits of our labor.

Once bonus checks arrive by the end of February, hungry workers often jump to a competing company for a guaranteed higher pay day. I somewhat regret not taking the money by jumping ship as well. I had been a loyal soldier at Credit Suisse for 11 years, and I passed up the opportunity to work in New York City at a start-up bank that offered me a two-year guarantee for more money.

For those of you who work full-time jobs, cherish Q4! Once you retire, you will lose the luxury of receiving full pay for taking it easy. It’s like being on paternity leave while still getting your full salary. Oh, how I wish I had enjoyed these benefits when I was working!

The importance of Santa Claus’s walk

the Santa Claus Rally It is often viewed as a measure of short-term market sentiment. When a rise fails to materialize, it could signal bearish sentiment or broader economic concerns for the coming year. Investors, often influenced by myths, tend to act on momentum – whether positive or negative.

Negative momentum in the stock market often persists until a big catalyst changes sentiment. Likewise, positive momentum can sustain itself, especially when uncertainty about the future diminishes, creating a feedback loop that drives further gains.

For example, markets sometimes rise after a new president is elected, based on current momentum and the start of the end of the year Santa Claus Rally.

The S&P 500 has generally performed well under the Biden/Harris administration, barring a bear market in 2022. Looking ahead, with Donald Trump back in office, there is optimism tied to his policies that favor lower taxes and less regulation — both of which could boost corporate profits And stock prices.

If Harris had won, the stock market momentum would likely have continued, because her victory would have removed uncertainty about the next four years. Its policies are likely to be similar to Biden’s, perhaps with a more moderate approach.

Invest for the long term

While the Santa Claus Rally has generally held up over time, its predictive power is far from certain, especially in volatile markets. Events such as geopolitical tensions, unexpected economic data, or shifts in Federal Reserve policy can easily overshadow this seasonal trend. However, some short-term traders may be inclined to take advantage of the rally, and look to day trade during this time period.

the Santa Claus Rally It remains a fascinating and much discussed phenomenon, underscoring the psychological and behavioral patterns that influence market movements. It serves as a reminder of how tradition and sentiment guide investor behavior, even in sophisticated financial markets.

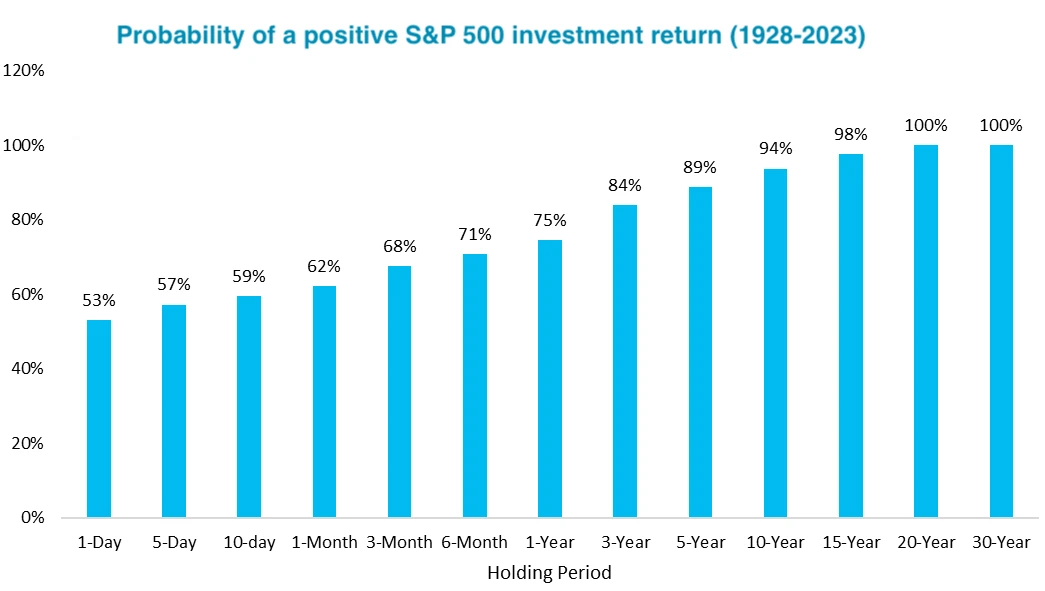

However, extreme emotion in either direction is rarely beneficial for investors. The best approach is to stay disciplined – dollar-cost average the market with your available cash flow and maintain a long-term investment perspective. Over time, consistency tends to trump chasing seasonal trends.

Readers, what do you think about the chances of Santa Claus rising this year, given the strong performance of the S&P 500 so far? Do you engage in any additional trading or rebalancing at the end of the year that may contribute to market momentum?

Diversification into private real estate

With strong stock performance, you may want to diversify into real estate. It is an investment that combines the stability of bond income with greater upside potential. The Fed is on a multi-year rate cutting cycle, and I expect demand for real estate to grow in the coming years.

It is considered Fundraisinga platform that allows you to invest 100% passively in residential and industrial real estate. With over $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower and returns tend to be higher.

I have personally invested over $270,000 with Fundrise, and they have been a trusted partner and long-time sponsor of Financial Samurai. With a minimum investment of $10, diversifying your investment portfolio is easier than ever.

Join over 60,000 others and subscribe to my free weekly newsletter here. Financial Samurai was founded in 2009 and is the leading personal finance website today. Everything is written based on first-hand experience because money is too important to be left to the papacy.