MSMEs are important to the country’s economy as they drive innovation, create jobs and contribute to GDP. MSME loans provide funds for MSME expansion or for carrying out day-to-day operations. However, the cost of these loans depends on the interest rate, which influences the financial health of MSMEs and their ability to grow.

MSME owners need to carefully understand the factors that influence these rates to get the best financing options. Lower interest rates can reduce the repayment burden, allowing businesses to invest more in operations and expansion.

Here we will look at the interest rate on MSME loans provided by LoanTap, how to calculate EMI and the factors that affect the interest rate.

The interest rate on an MSME loan refers to the fee a lender charges for providing money to a business. This rate makes it possible to determine the overall cost of the loan.

The interest rate on MSME loans depends on several factors, such as your credit score, as well as the loan amount and repayment term you choose.

| Details | Details |

| Loan amount | Min – 50,000, Max – 10 lakhs |

| Mandate | Min – 6 months, Max – 36 months |

| Age | Min-23, Max-58 (co-applicant required if age > 55) |

| Interest rate | 19.99% to 26% per year |

| Processing Fees | 2% to 2.99% + GST |

| Vintage Business | Min. 2 years |

| Office Score | >=700, NTC authorized (with loan amount capped) |

How to calculate MSME loan EMI?

To plan your finances effectively, it is important to know the interest payable for the loan amount you plan to borrow.

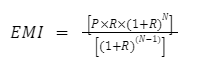

Below is how you can manually calculate interest amount and total EMI on business loans:

Or,

P = Principal amount

R = Interest rate

N = Mandate

With the above formula, you will be able to calculate the EMI payable. However, manual calculations are not always accurate. For accurate results, you can use LoanTap’s Loan EMI Calculator. All you need to do is visit the LoanTap website and enter the basic details, such as the desired loan amount, loan tenure, and the applicable interest rate.

An EMI calculator can help you determine your monthly EMI and the total interest amount that needs to be paid over the life of the loan.

Factors Affecting MSME Business Loan Interest Rate

Here are some factors that affect the interest rate of MSME business loans:

Solvency

Using the borrower’s financial history and credit score, lenders decide whether or not the loan should be approved and the interest rate that will be charged. Usually, borrowers with higher credit scores can get loans at lower interest rates, while those with lower credit scores may be charged higher rates.

Loan type

The type of loan also affects the interest rate. For example, secured loans generally have lower interest rates because they require collateral, which allows the lender to reclaim it if the borrower fails to repay. On the other hand, unsecured loans do not require collateral and often come with higher interest rates.

Loan amount

Higher loan amounts can result in lower interest rates because they generate more revenue for the lender. On the other hand, smaller loans may have higher rates.

Reimbursement duration

The amount of time you have to repay the loan, called the loan term, can also affect the interest rate in some cases. Longer repayment terms may come with lower interest rates because they can spread the burden of monthly payments from the borrower, but in some cases they may also have higher rates. Likewise, shorter terms may come with higher or lower rates depending on the lender’s approach.

Industry health

Lenders often look at the status of an industry and its chances of growth. If the sector faces difficulties, lenders could charge higher interest rates due to the risk of default. But if the sector has good growth potential, rates could be lower.

Market conditions

Interest rates may fluctuate based on current market conditions. If the economy is strong, interest rates may be lower due to increased competition among lenders. Conversely, during an economic downturn, rates could rise as lenders become more cautious.

Conclusion

Understanding the interest rate of MSME loans is important to manage your business finances effectively. To get the best loan terms, consider factors like industry health, your credit score, and market conditions.

Choosing the right lender is important because it affects the overall amount you will pay. LoanTap offers competitive interest rates on MSME Loansmaking it easier for you to achieve your business goals.

Frequently Asked Questions

How do MSME loan interest rates impact your EMI?

The interest rate directly affects the EMI of an MSME loan. A higher interest rate increases the EMI amount and total interest payable over the tenure of the loan. Conversely, a lower interest rate reduces EMIs and overall loan cost, depending on the tenure you choose.

How Does Business Owner’s Credit Score Affect MSME Loan Interest Rates?

The credit score of the business owner plays an important role in determining the interest rate of an MSME loan. A high credit score indicates good creditworthiness and may result in lower interest rates. Conversely, a low credit score presents a higher risk of default for the lender and can result in higher interest rates.

Are there any government programs offering lower interest rates for MSME loans?

Yes, several government programssuch as the Prime Minister’s Employment Generation Program (PMEGP) and the Credit Guarantee Fund for Micro and Small Enterprises (CGTMSE), provide subsidized interest rates and other benefits to encourage the growth of MSMEs . These programs often offer lower interest rates than traditional business loans.

Can interest rates on MSME loans change over time?

Yes, interest rates on MSME loans can be fixed or floating. Fixed interest rates remain constant over the life of the loan, ensuring repayment stability. Floating interest rates, on the other hand, fluctuate based on market conditions or changes in the lender’s base rate, affecting the EMI amounts.

Are there any additional charges apart from the interest rate for MSME loans?

Yes, in addition to the interest rate, borrowers may be required to pay additional fees such as processing fees, documentation fees, prepayment penalties, and late fees. It is important to review all associated costs with the lender before taking out an MSME loan.

Related blogs

MSME certificate: what is it and what are the benefits for your business?

10/21/2024

![]()

Who is eligible for MSME loan

09/20/2024

![]()

Government Schemes for MSMEs in India

07/15/2024

![]()