When applying for a loan, lenders consider several factors to ensure that you are a responsible borrower who can comfortably repay your debt. Lenders will only lend you money if they know you can repay them, but how can you be sure? This is where the debt-to-income ratio (DTI) comes into play.

It’s a factor that lenders consider when assessing your repayment capabilities, and understanding it can benefit your financial situation.

Read on to understand what debt-to-income ratio is, why it’s important, and how to calculate it.

What is the debt-to-income ratio (DTI)?

The debt-to-income ratio (DTI) is a financial measure that compares an individual’s monthly debt payments to their gross monthly income. Lenders commonly use it to assess a borrower’s ability to manage their monthly payments and repay their debts.

A lower DTI ratio indicates a healthier balance between debt and income, which suggests that the borrower is more likely to manage their debt payments effectively.

Conversely, a higher DTI ratio may indicate that the borrower has too much debt relative to their income and may have difficulty managing their obligations. Generally, lenders prefer a DTI ratio of 36% or less.

Importance of debt-to-income ratio

The debt-to-income (DTI) ratio is important for several reasons:

Loan decisions

Lenders use the DTI ratio to assess a borrower’s ability to manage their monthly payments and repay their debts. This is an important factor in the approval process for mortgages, auto loans, personal loans and credit cards.

Interest rate and loan terms

DTI is one of the important factors in deciding the loan terms. Borrowers with lower DTI ratios are typically offered better interest rates and more favorable loan terms because they are perceived as less likely to default on their loans. Conversely, a higher DTI ratio can result in higher interest rates and less favorable loan terms due to increased risk for the lender.

Financial health indicator

The DTI ratio is a good indicator of an individual’s financial health. It helps individuals understand their level of debt relative to their income and assess when they are heavily in debt.

Budgeting and planning

By calculating and understanding their DTI ratio, individuals can create more realistic budgets and financial plans. This helps them recognize how much of their income goes toward paying off their debts and allows them to plan to pay off their debts sooner, which can consequently reduce their debt over time.

Meet lender requirements

Lenders generally prefer a DTI ratio of 36% or less for different types of loans.

Risk management

For lenders, the DTI ratio is a risk management tool. This helps them assess the likelihood of loan repayment and reduce the risk of default.

How is the debt-to-income ratio calculated?

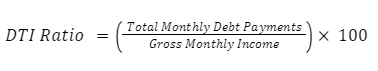

The debt-to-income ratio (DTI) is calculated by dividing an individual’s total monthly debt payments by their gross monthly income and multiplying the result by 100 to get a percentage.

Here is a step-by-step explanation of how to calculate it:

Step 1: Determine total monthly debt payments

Include all your recurring monthly debts, such as mortgage or rent payments, car loan payments, student loan payments, credit card payments (usually the minimum payment due), personal loan payments and any other payment of debts.

Step 2: Calculate gross monthly income

Gross monthly income is the total income earned before taxes and deductions. This includes salary, bonuses and commissions, overtime pay (if regular), pension and any other source of regular income.

Step 3: Apply the Formula

Use the following formula to calculate the DTI ratio:

Let’s understand the calculation of DTI with an example:

Step 1: Determine total monthly debt payments

- Home Loan EMI: ₹30,000

- Car loan EMI: ₹8,000

- Education Loan EMI: ₹4,000

- Minimum credit card payment: ₹3,000

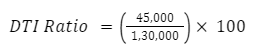

Total monthly debt payments = ₹30,000 + ₹8,000 + ₹4,000 + ₹3,000 = ₹45,000

Step 2: Calculate gross monthly income

- Salary: ₹1,20,000

- Bonus: ₹10,000

Gross monthly income = ₹1,20,000 + ₹10,000 = ₹1,30,000

Step 3: Calculate the DTI ratio

DTI ratio ≈ 34.62%

This percentage indicates that 34.62% of the individual’s gross monthly income is used to cover debt repayments, which can help lenders assess their creditworthiness.

What is a good debt-to-income ratio?

A good debt-to-income (DTI) ratio suggests a manageable level of debt to income, indicating financial stability and the ability to manage additional borrowing if necessary.

Here are some general guidelines on what constitutes a good DTI ratio:

Lenders generally prefer a DTI ratio of 36% or less. You will likely be considered a low-risk borrower who manages debt responsibly.

While not ideal, many lenders will still consider borrowers with a DTI ratio in this range, especially if other factors (such as a high credit score) are favorable.

Borrowers can still qualify for loans, but the interest rates and terms may not be as favorable as those offered to individuals with lower DTI ratios.

A DTI ratio above 43% is generally considered high and may indicate that the borrower has too much debt. This can make it difficult to get loans and, if approved, the terms may include higher interest rates.

Borrowers with high DTI ratios may have difficulty managing their monthly payments and are at greater risk of defaulting on their loans.

Conclusion

The debt-to-income ratio is an important metric that plays an important role in assessing the creditworthiness of lenders and can also help individuals determine their financial stability. A lower DTI ratio indicates a better balance between debt and income, increasing the likelihood of loan approval and favorable terms.

The DTI ratio is an important factor when it comes to approvals and decisions on terms of personal loans. Lenders use this number to determine your ability to repay the loan while managing existing obligations. A lower DTI ratio increases your chances of getting a personal loan with better interest rates and terms.

Frequently Asked Questions

How does the DTI ratio affect loan approval?

A lower DTI ratio increases the likelihood of loan approval and can result in better interest rates and loan terms. Lenders use the DTI ratio to assess the risk of lending to a borrower; a higher ratio suggests higher risk.

Can I improve my DTI ratio?

Yes, you can improve your DTI ratio by increasing your income or reducing your debt. Strategies include paying off high-interest debt, avoiding new debt, and refinancing existing loans to lower monthly payments.

Does the DTI ratio apply to all types of loans?

Yes, the DTI ratio is an important factor for various types of loans, including mortgages, auto loans, and personal loans. Each loan type may have different acceptable DTI ratio thresholds, but a lower ratio is generally preferred for all loan types.

How often should I check my DTI ratio?

It’s a good idea to check your DTI ratio periodically, especially before applying for a loan. Regular monitoring can help you stay on top of your financial health and make informed decisions about managing your debt.

What happens if my DTI ratio is too high?

If your DTI ratio is too high, you may have difficulty obtaining loans or receive less favorable terms and higher interest rates. This indicates that you are over-indebted and may struggle to manage additional debt. You can try paying off your existing debts to maintain your DTI ratio.