Have you ever wondered why you pay interest on a loan or earn interest on your savings? It all depends on interest rates. Interest rates affect everything from mortgage and auto loans to the financial activities of businesses and governments.

When you borrow money, you pay a fee to use it for a certain period of time. These charges are called interest rates and are usually expressed as an annual percentage. This is how banks and other financial institutions make money by lending you money.

Keep reading to learn more about interest rates, their types, how they work, and the factors that affect them.

What is an interest rate?

An interest rate is a percentage charged or earned on the amount borrowed or lent for a specified period of time. This is essentially the cost of borrowing money or the return on investment of savings.

There are two main types of interest rates:

- Fixed interest rate: this rate remains constant throughout the duration of the loan or investment.

- Variable interest rate: This rate may fluctuate based on market conditions or an index.

These rates are generally calculated annually and apply to both personal and business loans.

How do interest rates work?

Interest rates determine the cost of borrowing or the return on savings.

Let’s understand the two scenarios:

When you apply for a loan, you must repay the amount borrowed plus interest. For example, if you borrow ₹1,000 at an interest rate of 5%, you will have to pay ₹50 in interest every year.

When you deposit money into a savings account or invest, you earn interest on your balance. The interest rate determines how much you will earn over time. For example, if you deposit ₹1,000 in a savings account at an interest rate of 2%, you will earn ₹20 in interest over a year.

Types of Interest Rates

Here are the different types of interest rates and their impact on the principal amount and overall repayment:

Fixed interest rate:

A fixed interest rate remains constant throughout the life of the loan and must be repaid each month along with the principal amount. This is the most common type of interest rate applied to loans and provides stability and predictability in loan payments. For example, business loans and personal loans typically have fixed interest rates.

Floating or variable interest rate:

Variable interest rates may change over time, depending on market conditions or benchmarks set by the RBI. The terms of your loan determine which benchmark affects your interest rate, resulting in a change in loan payments. For example, car loans often have variable interest rates.

Simple interest rate:

A simple or regular interest rate is charged on the principal amount for a specific term. It is based on a simple calculation of how much you owe. It does not take into account other factors such as time, inflation or repayment schedule. Calculating simple interest is easy using the formula – IF = P x R x Twhere P is the principal amount, R is the annual interest rate and T is the period (in years).

Compound interest rate:

Compound interest, also called “interest on interest,” is a method in which interest earned is added to the principal amount and future interest calculations are based on this new principal. Here, interest is earned on both the original principal and the accrued interest from previous periods.

How to calculate the amount of interest?

There are two types of interest rates: simple interest and compound interest. Let’s see how to calculate interest using these two types:

Simple interest:

Simple interest is a simple way to calculate the interest earned or paid on the principal amount. This rate remains constant throughout the duration of the loan and is calculated only on the initial principal amount. It is primarily used for short-term loans or investments where interest does not accrue over time.

Now let’s see how to calculate simple interest.

The simple interest formula is:

IF = P x R x T

Or,

P = Principal amount (the initial amount)

R = Annual interest rate (expressed as a decimal)

T = Period (in years)

Let’s look at an example

Suppose you invest ₹1,000 at an annual interest rate of 5% for 3 years.

So here the principal amount (P) is ₹1000, the annual interest rate (R) is 5% or 0.05 and the period (T) is 3 years.

Using these values you can calculate the interest rate,

IF = 1000 x 0.05 x 3

So, the simple interest (SI) earned over 3 years is ₹150.

To find the total amount (A) after adding interest, use the formula:

A = P + SI

A = 1000 + 150

Therefore, the total amount after 3 years will be ₹1,150.

Compound interest:

The compound interest calculation includes the principal amount, the interest rate, the number of times the interest is compounded per year, and the total number of years the money is invested or borrowed.

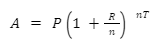

The compound interest rate formula is:

Or:

A = The future value of the investment/loan, including interest

P = Principal amount (initial amount)

R = Annual interest rate (in decimal form)

n = Number of times interest is compounded per year

T = Period (in years)

Let’s look at an example of a compound interest rate to better understand this.

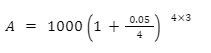

Suppose you invest ₹1,000 (P) at an annual interest rate of 5%, compounded quarterly (n=4), for 3 years (T).

Using these values in the formula you will get

By solving this equation, you will get

A = 1161.62

So, the future value of the investment/loan after 3 years will be ₹1,161.62.

Factors Affecting Interest Rates

Interest rates are not set in stone. Although they impact investment returns and loan repayment costs, they are influenced by various factors such as the health of the economy, inflation, supply and demand, government policies, credit risk and loan term.

Economic health

A growing economy with low unemployment increases demand for goods and services. Businesses borrow more to meet this demand, driving up interest rates. On the other hand, a weak economy leads to lower rates as lenders become less confident due to higher default risks and lower borrowing needs.

Inflation

Rising inflation forces lenders to raise interest rates. They need a higher return to ensure that their investment does not lose value due to rising prices.

Government policy

Government policies play an important role in setting interest rates. For example, the RBI adjusts short-term interest rates to control inflation and stimulate economic activity. These adjustments often have a domino effect, also affecting loan and credit card rates.

Supply and demand

As in any market, interest rates are dictated by supply and demand. Lenders can charge more when there is high demand for loans because they have more opportunities to lend profitably. Conversely, when borrowing demand is low, lenders lower rates to attract borrowers.

Credit risk

Lenders charge higher interest rates to borrowers considered risky to compensate for the risk that they will default on the loan. On the other hand, borrowers with good credit generally receive lower interest rates because they are considered less risky.

Loan duration

The interest rate is strongly influenced by the duration of the loan. With longer loan terms, interest rates can increase to cover additional risks lenders may face over time.

Conclusion

Interest rates serve as a bridge between borrowers and lenders. They represent the cost of borrowing to the borrower, like a fee for using someone else’s money. For example, this cost is reflected in the interest rate of a personal loanthat you would pay in addition to the principal repayment. Conversely, lenders get a return on the money they lent in the form of interest. Banks and financial institutions use the money they earn from loans to pay interest on savings accounts and certificates of deposit.

So whether you’re borrowing to consolidate debt with a personal loan or saving for a future purchase, understanding interest rates helps you make informed financial decisions.

Frequently Asked Questions

How is the interest rate determined?

Interest rates are determined by factors such as central bank policies, inflation rates, economic conditions and the creditworthiness of the borrower.

What role do central banks play in setting interest rates?

Central banks, such as the RBI, set benchmark interest rates to influence economic activity, control inflation and stabilize the currency.

What is the difference between nominal and real interest rates?

Nominal interest rates are the rates quoted without adjusting for inflation, while real interest rates account for inflation and reflect the true cost of borrowing or return on investment.

How are personal loan interest rates calculated?

Personal loan interest rates are generally calculated based on the borrower’s credit score, income, and the term of the loan amount.

What is an APR and how is it different from an interest rate?

The APR (Annual Percentage Rate) includes the interest rate and other costs or fees involved in securing the loan, providing a more complete view of the cost of borrowing.